Building wealth takes time, discipline, and smart decisions. Many people focus on investments alone, yet a strong long-term plan needs protection as well. Insurance plays a quiet but powerful role in keeping your financial foundation stable. It shields you from losses that can undo years of progress. It also supports your goals by adding security and structure. When used well, insurance becomes a key part of your overall strategy and not just an extra expense. It helps you move forward with confidence and protects what you work hard to build.

Understanding the True Value of Protection

Insurance protects your assets and future income. Without coverage, a single event can drain your savings or disrupt your plans. Protection keeps your long-term growth steady even when unexpected problems arise. It also gives peace of mind because it reduces financial shocks. When your downside risks are covered, you can focus on building wealth instead of worrying about what might go wrong.

Identifying Coverage That Supports Your Goals

Every person has different financial aims. Some want to grow investments aggressively. Others want long-term stability with fewer risks. The first step is matching insurance to those goals. Life insurance supports families by replacing income. Health coverage prevents huge medical bills. Disability insurance protects earning ability. Property insurance safeguards physical assets. Each type supports a specific need. You do not need every policy available. You only need coverage that aligns with your plans and lifestyle. Thoughtful choices help avoid spending too much while keeping your future secure.

Using Insurance to Strengthen Investment Plans

Insurance works alongside investments rather than competing with them. Certain policies, like whole life or variable insurance, offer cash value components that grow over time. They are not replacements for traditional investments, but they add stability. These policies can serve as safety nets when markets fall. They also provide liquidity because some allow withdrawals or loans. This flexibility helps you navigate changing financial conditions. While returns on cash value products may be modest, they offer guaranteed elements that bring balance to more volatile investments. With proper planning, they add structure to your long-term wealth strategy.

Managing Risk With Long-Term Planning

Wealth-building always carries some level of risk. The goal is not to eliminate risk but to manage it. Insurance reduces the impact of events outside your control. By doing so, it helps maintain consistent progress. For long-term plans, stability matters. Even a small setback can slow momentum. Large setbacks can reverse years of effort. Insurance minimizes these disruptions. Think of it as a foundation that supports everything else. The right coverage ensures your plan stays intact even when life changes suddenly.

Supporting Family and Legacy Goals

Long-term wealth is not only about personal success. Many people want to secure their family’s future as well. Insurance helps with legacy planning by providing financial support that passes smoothly to dependents. Life insurance, in particular, plays a central role. It can cover estate taxes, replace income, or create an inheritance. It also protects loved ones from financial hardship. By including insurance in your long-term strategy, you create stability for the next generation. You also gain clarity in planning because you know certain needs will be met regardless of circumstances.

Balancing Costs and Benefits

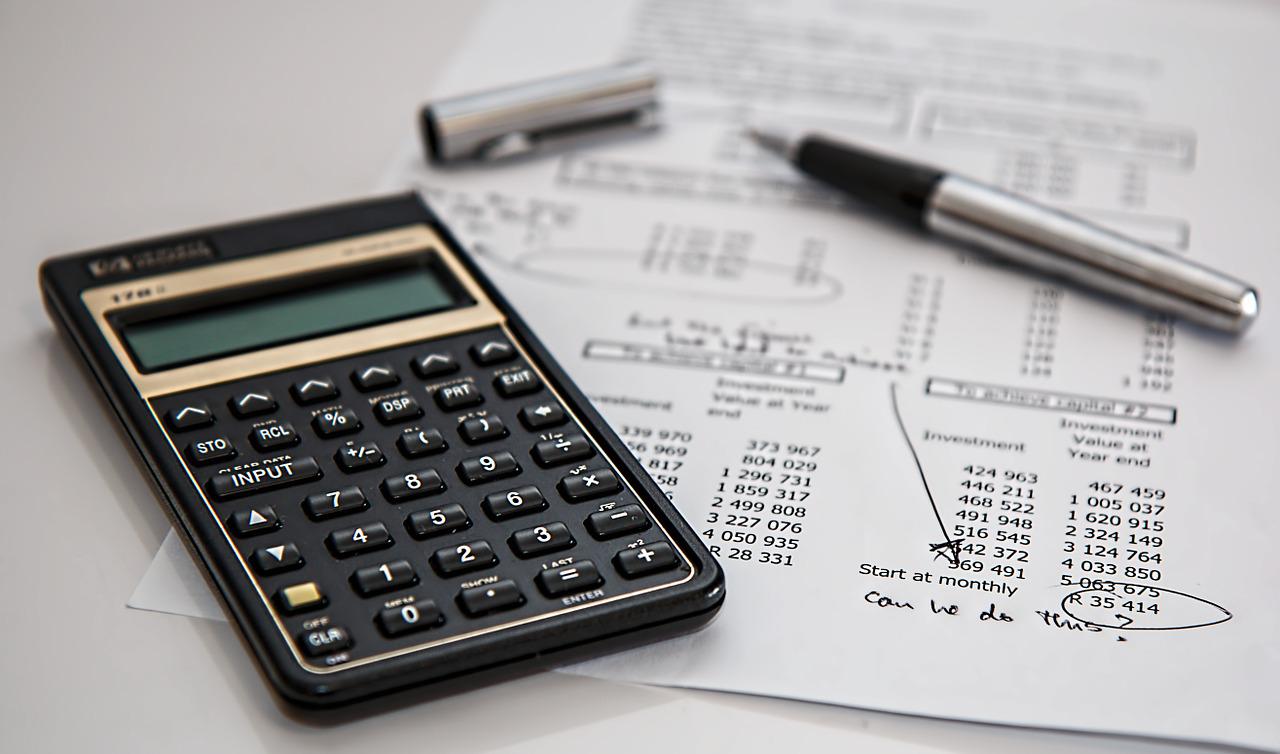

Insurance requires ongoing payments, so the cost must be managed. The goal is to strike a balance that strengthens your financial plan without limiting growth. Evaluating policies carefully helps avoid unnecessary spending. Compare coverage, premiums, and long-term value. Choose policies that match real needs and avoid coverage that offers little benefit. Savings from efficient planning can be redirected into investments. This balance keeps your strategy flexible and sustainable. When done right, insurance supports wealth growth instead of burdening it. It also ensures you maintain protection without stretching your budget.

Every long-term wealth plan should be unique. Your income, family needs, risk tolerance, and financial goals shape your path. That means your insurance choices should follow the same logic. Work with advisors who understand your full financial picture. Review your coverage regularly. Adjust it when your life changes. Strong planning requires updates as goals evolve. Treat insurance as an active part of your strategy, not something set once and forgotten. This approach helps keep your protection strong and your progress steady. Over time, the combined effect …

Before diving into repairs, assessing the damage and creating a plan of action is important. Depending on the severity of the fire, you may need to hire a professional inspector to evaluate the structural integrity of your home. They can also help identify hidden damage that may not be immediately visible.

Before diving into repairs, assessing the damage and creating a plan of action is important. Depending on the severity of the fire, you may need to hire a professional inspector to evaluate the structural integrity of your home. They can also help identify hidden damage that may not be immediately visible. For repairs that require professional assistance, it’s important to shop around and get multiple quotes from different contractors. This will not only give you a better understanding of the average cost for repairs, but it also allows you to compare prices and services offered. Be sure to ask for references and check their credentials to ensure you are hiring a reputable and experienced contractor.

For repairs that require professional assistance, it’s important to shop around and get multiple quotes from different contractors. This will not only give you a better understanding of the average cost for repairs, but it also allows you to compare prices and services offered. Be sure to ask for references and check their credentials to ensure you are hiring a reputable and experienced contractor. When hiring contractors, communicate your budget constraints clearly. Experienced professionals can often suggest cost-effective solutions and materials that meet your financial goals. It’s important to have open and honest communication with contractors throughout the repair process so there are no surprise costs or misunderstandings.

When hiring contractors, communicate your budget constraints clearly. Experienced professionals can often suggest cost-effective solutions and materials that meet your financial goals. It’s important to have open and honest communication with contractors throughout the repair process so there are no surprise costs or misunderstandings.

This technique involves smoothly following a subject as it moves through a scene, creating a sense of movement and momentum. With a drone’s ability to seamlessly glide through the air, capturing stunning tracking shots has become easier than ever before. Incorporating a tracking shot into your storytelling can add depth and excitement to your footage.

This technique involves smoothly following a subject as it moves through a scene, creating a sense of movement and momentum. With a drone’s ability to seamlessly glide through the air, capturing stunning tracking shots has become easier than ever before. Incorporating a tracking shot into your storytelling can add depth and excitement to your footage.

As the sun rises on the morning of your wedding day, a sense of anticipation fills the air. The groom, surrounded by his closest friends and family, begins to prepare for the moment when he will stand at the altar and say, “I do.” This is a precious time that often goes unnoticed amidst all the hustle and bustle of wedding preparations.

As the sun rises on the morning of your wedding day, a sense of anticipation fills the air. The groom, surrounded by his closest friends and family, begins to prepare for the moment when he will stand at the altar and say, “I do.” This is a precious time that often goes unnoticed amidst all the hustle and bustle of wedding preparations. The moment when the flower girls walk down the aisle is always a heartwarming and magical scene. Capturing this in motion blur adds an extra element of enchantment to your editorial wedding photoshoots. As they make their way toward the altar, their delicate dresses twirl around them, creating a beautiful blur of movement.

The moment when the flower girls walk down the aisle is always a heartwarming and magical scene. Capturing this in motion blur adds an extra element of enchantment to your editorial wedding photoshoots. As they make their way toward the altar, their delicate dresses twirl around them, creating a beautiful blur of movement.

The first step to take when considering purchasing cannabis online is to research state and local laws. Depending on where you live, the regulations surrounding cannabis can vary greatly. It is important to be aware of these laws before purchasing, as breaking them could result in serious penalties.

The first step to take when considering purchasing cannabis online is to research state and local laws. Depending on where you live, the regulations surrounding cannabis can vary greatly. It is important to be aware of these laws before purchasing, as breaking them could result in serious penalties. When buying cannabis online, reviews and questions are your best friend. Take the time to read reviews of the different online dispensaries before making a purchase, and don’t hesitate to ask questions if you’re unsure about anything. Cannabis is a relatively new industry, meaning not all online dispensaries are created equal.

When buying cannabis online, reviews and questions are your best friend. Take the time to read reviews of the different online dispensaries before making a purchase, and don’t hesitate to ask questions if you’re unsure about anything. Cannabis is a relatively new industry, meaning not all online dispensaries are created equal.

Freezer bags, also known as zip-top bags, are a popular choice for freezing food. The beauty of using these bags is their flexibility – they can easily conform to the shape of your food, making them great for storing odd-shaped items. Freezer bags are also famous for their thicker materials compared to regular plastic storage bags. This helps prevent freezer burn and keeps your food fresher for longer periods. But look for ones that specifically say “freezer safe” or “freezer-grade” on the packaging.

Freezer bags, also known as zip-top bags, are a popular choice for freezing food. The beauty of using these bags is their flexibility – they can easily conform to the shape of your food, making them great for storing odd-shaped items. Freezer bags are also famous for their thicker materials compared to regular plastic storage bags. This helps prevent freezer burn and keeps your food fresher for longer periods. But look for ones that specifically say “freezer safe” or “freezer-grade” on the packaging. Airtight containers are another must-have gear for keeping your frozen items fresh and protected. Coming in different sizes and shapes, they can do wonders to prevent moisture from entering or escaping. So, it can preserve the texture and flavor of your food and keep it just as delicious as possible when you first freeze it. Additionally, these

Airtight containers are another must-have gear for keeping your frozen items fresh and protected. Coming in different sizes and shapes, they can do wonders to prevent moisture from entering or escaping. So, it can preserve the texture and flavor of your food and keep it just as delicious as possible when you first freeze it. Additionally, these

One of the most common types of scam websites is phishing. Phishing scams are designed to steal your personal information, such as your credit card number or login credentials. These scams typically involve the scammers sending you an email that looks like it is from a legitimate website or company. Once you input your personal information into the fake website, the scammers will access it.

One of the most common types of scam websites is phishing. Phishing scams are designed to steal your personal information, such as your credit card number or login credentials. These scams typically involve the scammers sending you an email that looks like it is from a legitimate website or company. Once you input your personal information into the fake website, the scammers will access it. These websites will promise you a chance to win a large sum of money or an expensive prize if you enter their contest. However, the only way to enter is to provide your personal information or pay a fee. Once they have your information, they will sell it to marketing companies or use it to scam other people. You will probably never see the prize even if you win the contest. They will ask you to provide your personal information and then sell it or use it to scam other people.

These websites will promise you a chance to win a large sum of money or an expensive prize if you enter their contest. However, the only way to enter is to provide your personal information or pay a fee. Once they have your information, they will sell it to marketing companies or use it to scam other people. You will probably never see the prize even if you win the contest. They will ask you to provide your personal information and then sell it or use it to scam other people.

Cleaning your solar panels regularly is crucial to maintaining their efficiency. However, using the wrong cleaning solution can do more harm than good. For instance, using too abrasive cleaner can damage the surface of your solar panels, making them less effective at capturing sunlight. In addition, using a cleaning solution not designed for solar panels can leave behind streaks and residue, which can also impact their performance.

Cleaning your solar panels regularly is crucial to maintaining their efficiency. However, using the wrong cleaning solution can do more harm than good. For instance, using too abrasive cleaner can damage the surface of your solar panels, making them less effective at capturing sunlight. In addition, using a cleaning solution not designed for solar panels can leave behind streaks and residue, which can also impact their performance. Another common mistake homeowners make is failing to monitor their solar panel’s battery. Like any other battery, solar batteries can degrade over time. This degradation can impact the performance of your solar panels and, in some cases, may even cause them to stop working altogether. To avoid this, check your solar panel’s battery regularly and replace it as needed.

Another common mistake homeowners make is failing to monitor their solar panel’s battery. Like any other battery, solar batteries can degrade over time. This degradation can impact the performance of your solar panels and, in some cases, may even cause them to stop working altogether. To avoid this, check your solar panel’s battery regularly and replace it as needed. Finally, one of the most common mistakes homeowners make is neglecting to have their solar panels serviced regularly. Like any other equipment, solar panels require occasional checkups to ensure they function correctly. These checkups can help pinpoint possible issues before becoming severe, saving you money later on.

Finally, one of the most common mistakes homeowners make is neglecting to have their solar panels serviced regularly. Like any other equipment, solar panels require occasional checkups to ensure they function correctly. These checkups can help pinpoint possible issues before becoming severe, saving you money later on.

One of the main reasons why plate heat exchangers are so popular is because they are incredibly versatile. They can be used in a wide variety of applications, which makes them ideal for use in many different industries. Many businesses use them to transfer heat from one process to another, such as in the food and beverage industry. They can also be used in HVAC systems to help improve the system’s efficiency. You will often find them in large buildings and office complexes.

One of the main reasons why plate heat exchangers are so popular is because they are incredibly versatile. They can be used in a wide variety of applications, which makes them ideal for use in many different industries. Many businesses use them to transfer heat from one process to another, such as in the food and beverage industry. They can also be used in HVAC systems to help improve the system’s efficiency. You will often find them in large buildings and office complexes. The third reason to use plate heat exchangers is that they are very inexpensive. This means that you will not have to spend a lot of money on the device, and you can save a considerable amount of money in the long run. In addition, these devices are straightforward to maintain, so you will not have to worry about spending a lot of money on repairs. Many people think that these devices are too expensive, but when you compare the cost of the device to other types of heat exchangers, you will see that they are actually very affordable.

The third reason to use plate heat exchangers is that they are very inexpensive. This means that you will not have to spend a lot of money on the device, and you can save a considerable amount of money in the long run. In addition, these devices are straightforward to maintain, so you will not have to worry about spending a lot of money on repairs. Many people think that these devices are too expensive, but when you compare the cost of the device to other types of heat exchangers, you will see that they are actually very affordable.

Weedmaps is one of the most popular cannabis apps, with millions of downloads. It’s also one of the few that offers CBD delivery. You can use Weedmaps to find dispensaries near you and order CBD products for delivery. The app offers a wide selection of CBD products, including tinctures, edibles, topicals, and more.

Weedmaps is one of the most popular cannabis apps, with millions of downloads. It’s also one of the few that offers CBD delivery. You can use Weedmaps to find dispensaries near you and order CBD products for delivery. The app offers a wide selection of CBD products, including tinctures, edibles, topicals, and more. Kushy is another great option for CBD delivery. They offer a wide range of products, including tinctures, topicals, edibles, and more. They also have a great selection of strains to find the perfect one for your needs. Delivery is quick and easy with Kushy, so you can get your CBD fixed as soon as possible.

Kushy is another great option for CBD delivery. They offer a wide range of products, including tinctures, topicals, edibles, and more. They also have a great selection of strains to find the perfect one for your needs. Delivery is quick and easy with Kushy, so you can get your CBD fixed as soon as possible.

One option for business owners who need financing but don’t have any collateral is to take out a working capital loan. Working capital loans help businesses with their day-to-day expenses, such as payroll or inventory costs. Because these loans are not used for long-term investments, they typically don’t require collateral. In addition, working capital loans can be easier to qualify for than traditional business loans.

One option for business owners who need financing but don’t have any collateral is to take out a working capital loan. Working capital loans help businesses with their day-to-day expenses, such as payroll or inventory costs. Because these loans are not used for long-term investments, they typically don’t require collateral. In addition, working capital loans can be easier to qualify for than traditional business loans. Technology financing allows businesses to fund the purchase of new technology, such as computers or software. Many times, these types of loans are available through the government or through private lenders. Like working capital loans, technology financing can be easier to qualify for than traditional business loans.

Technology financing allows businesses to fund the purchase of new technology, such as computers or software. Many times, these types of loans are available through the government or through private lenders. Like working capital loans, technology financing can be easier to qualify for than traditional business loans. Another option for business owners who need financing but don’t have any collateral is to take out a personal loan. Personal loans are designed for individuals, not businesses. However, they can be used for business purposes if the borrower has good credit. Because private loans are unsecured, they typically don’t require collateral. Securing business financing without collateral can be a challenge, but it’s not impossible.

Another option for business owners who need financing but don’t have any collateral is to take out a personal loan. Personal loans are designed for individuals, not businesses. However, they can be used for business purposes if the borrower has good credit. Because private loans are unsecured, they typically don’t require collateral. Securing business financing without collateral can be a challenge, but it’s not impossible.

The heel cup is the most important support in a shoe. It should be wide enough to cradle your heel without being so loose that your foot slides inside the shoe. The best heel cups are made of firm, padded material to hold your foot in place while you walk or run. If you have problems with your heels, look for a shoe with a good heel cup. This will help to support your feet and prevent further injury.

The heel cup is the most important support in a shoe. It should be wide enough to cradle your heel without being so loose that your foot slides inside the shoe. The best heel cups are made of firm, padded material to hold your foot in place while you walk or run. If you have problems with your heels, look for a shoe with a good heel cup. This will help to support your feet and prevent further injury. A metatarsal pad is a small silicone or gel cushion that you place under the ball of your foot, behind the toes. It helps relieve pressure on the metatarsal bones and joints and can be used to treat many foot problems, including metatarsalgia, Morton’s neuroma, and plantar fasciitis. If you have any of these conditions or want to prevent pain in the ball of your foot, a metatarsal pad can be a great option. You can find them at most drugstores or online, and they’re relatively inexpensive. Just make sure to get one that’s the right size for your foot.

A metatarsal pad is a small silicone or gel cushion that you place under the ball of your foot, behind the toes. It helps relieve pressure on the metatarsal bones and joints and can be used to treat many foot problems, including metatarsalgia, Morton’s neuroma, and plantar fasciitis. If you have any of these conditions or want to prevent pain in the ball of your foot, a metatarsal pad can be a great option. You can find them at most drugstores or online, and they’re relatively inexpensive. Just make sure to get one that’s the right size for your foot.

By employing people with

By employing people with  People with disabilities are often dependable employees. They know how to work hard and take their job seriously. They are not afraid of a challenge and are always willing to learn new things. In addition, people with disabilities are less likely to call in sick or take vacation days.

People with disabilities are often dependable employees. They know how to work hard and take their job seriously. They are not afraid of a challenge and are always willing to learn new things. In addition, people with disabilities are less likely to call in sick or take vacation days.

The height of anti-climb fencing is one of the most important things to consider when choosing a fence. The general rule with heights is that taller fences are more effective at preventing criminals from entering your property. This may seem obvious, but it’s worth noting because not all anti-climb fencing has been designed with this in mind.

The height of anti-climb fencing is one of the most important things to consider when choosing a fence. The general rule with heights is that taller fences are more effective at preventing criminals from entering your property. This may seem obvious, but it’s worth noting because not all anti-climb fencing has been designed with this in mind. While durability is an essential factor, you should also think about how your fence will look once installed. If you want it to be visible from the road, make sure that there isn’t any space between panels as this could allow passers-byes to see into your garden or property. Also, consider whether or not they can climb over any part of the fence easily .

While durability is an essential factor, you should also think about how your fence will look once installed. If you want it to be visible from the road, make sure that there isn’t any space between panels as this could allow passers-byes to see into your garden or property. Also, consider whether or not they can climb over any part of the fence easily .

The first step you should take is to dispute any inaccurate information on your credit report. If items on your account are not accurate, you can contact the credit bureau and ask them to remove them. Remember, you are allowed one free credit report per year from each of the three major bureaus, so be sure to check your report regularly and dispute any inaccurate information.

The first step you should take is to dispute any inaccurate information on your credit report. If items on your account are not accurate, you can contact the credit bureau and ask them to remove them. Remember, you are allowed one free credit report per year from each of the three major bureaus, so be sure to check your report regularly and dispute any inaccurate information. Another thing lenders look at when determining your creditworthiness is your debt to income ratio. This is the monthly debt you have compared to your monthly income. Lenders want to see that you can afford a new loan, and they will use your debt to income ratio as one factor in making their decision.

Another thing lenders look at when determining your creditworthiness is your debt to income ratio. This is the monthly debt you have compared to your monthly income. Lenders want to see that you can afford a new loan, and they will use your debt to income ratio as one factor in making their decision.

When it comes to your career, getting an edge over the competition is critical. You can gain knowledge and skills that set you apart from other job candidates with an online course. It can give you a leg up in the job market and help you get your dream career.

When it comes to your career, getting an edge over the competition is critical. You can gain knowledge and skills that set you apart from other job candidates with an online course. It can give you a leg up in the job market and help you get your dream career. An online course will save you time and offer flexibility. It’s the perfect solution for those looking to further education or change careers but doesn’t have much free time. If you work full-time, spend your evenings with family, or travel frequently, taking an online course is ideal because you can do it from any location. You can also tailor your coursework to fit your schedule instead of the other way around! So, you can learn at your own pace.

An online course will save you time and offer flexibility. It’s the perfect solution for those looking to further education or change careers but doesn’t have much free time. If you work full-time, spend your evenings with family, or travel frequently, taking an online course is ideal because you can do it from any location. You can also tailor your coursework to fit your schedule instead of the other way around! So, you can learn at your own pace.

Another important property to consider is the maximum layer thickness for each cast. It tells you how thick of a layer you can apply before it starts to cure. If you are looking to do a project with lots of layers, you’ll need an epoxy resin with a high maximum layer thickness. Conversely, if your project only requires one or two layers, you can choose a product with a lower maximum layer thickness. Some epoxy resins also have a minimum layer thickness, the thinnest layer that the resin will cure properly. It is essential to consider if you are doing very detailed work or working with small pieces.

Another important property to consider is the maximum layer thickness for each cast. It tells you how thick of a layer you can apply before it starts to cure. If you are looking to do a project with lots of layers, you’ll need an epoxy resin with a high maximum layer thickness. Conversely, if your project only requires one or two layers, you can choose a product with a lower maximum layer thickness. Some epoxy resins also have a minimum layer thickness, the thinnest layer that the resin will cure properly. It is essential to consider if you are doing very detailed work or working with small pieces. The length of the curing process and the adhesiveness of various kinds of

The length of the curing process and the adhesiveness of various kinds of

Aspera is a good choice for companies looking to increase download speeds. Since Aspera has been designed to be faster than other file transfer services, it can help you save time and money while transferring files over the internet. It is much faster than FTP and is often faster than even the built-in file transfer features of popular applications like Microsoft Office. It is secure with 128-bit encryption, which will help you avoid security breaches that are inconvenient or even costly. They are known to have a 99.999% uptime, so you can be sure that your transfers will always be available when you need them. Aspera is also a good choice for companies with large files to transfer.

Aspera is a good choice for companies looking to increase download speeds. Since Aspera has been designed to be faster than other file transfer services, it can help you save time and money while transferring files over the internet. It is much faster than FTP and is often faster than even the built-in file transfer features of popular applications like Microsoft Office. It is secure with 128-bit encryption, which will help you avoid security breaches that are inconvenient or even costly. They are known to have a 99.999% uptime, so you can be sure that your transfers will always be available when you need them. Aspera is also a good choice for companies with large files to transfer. You must have a paid account before uploading any files. This can be inconvenient if you want to upload one file for free, but most companies will need the benefits of a paid account. Aspera is not compatible with all operating systems. It only works on Windows and Mac OS at this time, so it may not work well with your Linux or Unix servers.

You must have a paid account before uploading any files. This can be inconvenient if you want to upload one file for free, but most companies will need the benefits of a paid account. Aspera is not compatible with all operating systems. It only works on Windows and Mac OS at this time, so it may not work well with your Linux or Unix servers.

If you are thinking of buying cannabis products online, make sure to do your research first. A quick Google search should give you a good idea of whether or not they’re reputable and what customers have said about them in their reviews. You can also check customer service numbers if there are any issues with delivery or quality later.

If you are thinking of buying cannabis products online, make sure to do your research first. A quick Google search should give you a good idea of whether or not they’re reputable and what customers have said about them in their reviews. You can also check customer service numbers if there are any issues with delivery or quality later. When you are ready to buy cannabis products online, it’s time to look at shipping options. Who can deliver faster? What international locations do they ship to? How much will the price differs based on where you live and how many items you’re buying?

When you are ready to buy cannabis products online, it’s time to look at shipping options. Who can deliver faster? What international locations do they ship to? How much will the price differs based on where you live and how many items you’re buying?

The first question should aim to find out the clinic’s physical location where you will undergo chiropractic treatment. Ideally, the clinic should be near your home. That will make it a lot easier and convenient for you to attend your clinic sessions. It will also help to narrow down your options, making the search process a bit easier. However, keep in mind that some great chiropractors might be worth considering even if they are not based near your home.

The first question should aim to find out the clinic’s physical location where you will undergo chiropractic treatment. Ideally, the clinic should be near your home. That will make it a lot easier and convenient for you to attend your clinic sessions. It will also help to narrow down your options, making the search process a bit easier. However, keep in mind that some great chiropractors might be worth considering even if they are not based near your home. If you have medical insurance cover, you should consider getting treatment from a chiropractic clinic that is covered by it. That will help you avoid going into your pocket to pay for the sessions you will have. Depending on your condition, you might need to go for several sessions that might end up being quite costly. If your insurance has limits to the number of sessions it can cover, ensure you pay attention to limitations, if any. You can compare the fees charged by the different chiropractors to help you make the right choice.

If you have medical insurance cover, you should consider getting treatment from a chiropractic clinic that is covered by it. That will help you avoid going into your pocket to pay for the sessions you will have. Depending on your condition, you might need to go for several sessions that might end up being quite costly. If your insurance has limits to the number of sessions it can cover, ensure you pay attention to limitations, if any. You can compare the fees charged by the different chiropractors to help you make the right choice.

This type of portable extinguisher is effective at extinguishing class B fires. In most cases, it is located near flammable liquids. The main types of Fire Extinguishers are mechanical and chemical. The chemical foam extinguisher uses aluminum sulfate and sodium bicarbonate chemicals. When you struck the plunger, the two chemicals mix to produce carbon dioxide, which forces out the foam. These fire extinguishers are not recommended in confined areas because they release poisonous gases.

This type of portable extinguisher is effective at extinguishing class B fires. In most cases, it is located near flammable liquids. The main types of Fire Extinguishers are mechanical and chemical. The chemical foam extinguisher uses aluminum sulfate and sodium bicarbonate chemicals. When you struck the plunger, the two chemicals mix to produce carbon dioxide, which forces out the foam. These fire extinguishers are not recommended in confined areas because they release poisonous gases. This type of fire extinguisher is designed to put out Class A fires. These types of fire extinguishers are commonly installed in accommodation areas. The major components of the extinguishing agent include sulfuric acid and soda. When they are combined, they produce carbon dioxide gas that smothers the fire.

This type of fire extinguisher is designed to put out Class A fires. These types of fire extinguishers are commonly installed in accommodation areas. The major components of the extinguishing agent include sulfuric acid and soda. When they are combined, they produce carbon dioxide gas that smothers the fire. The extinguisher features two containers. Its outer one contains water, whereas the inner one contains foam solution and carbon dioxide. When the plunger mechanism is depressed, it releases carbon dioxide. This allows water and foam to mix, which then come out to extinguish the fire.

The extinguisher features two containers. Its outer one contains water, whereas the inner one contains foam solution and carbon dioxide. When the plunger mechanism is depressed, it releases carbon dioxide. This allows water and foam to mix, which then come out to extinguish the fire.

You need your dog to be comfortable just as much as you would like to be comfortable at all times. Sometimes your dog may be tired from walking, playing and doing other activities with you. After a tiring and playful day, they need to have adequate rest for them to do the same another day. A good dog bed will give them the proper comfort to enable them to get relaxed. If you keep your dog comfortable, it will love you more, and rarely let anyone attack you.

You need your dog to be comfortable just as much as you would like to be comfortable at all times. Sometimes your dog may be tired from walking, playing and doing other activities with you. After a tiring and playful day, they need to have adequate rest for them to do the same another day. A good dog bed will give them the proper comfort to enable them to get relaxed. If you keep your dog comfortable, it will love you more, and rarely let anyone attack you. Dogs do not know how to respect a person’s space. If you do not have a nice, cosy and comfortable place set up for them, they will invade yours. Every night you will feel your dog on your comfortable bed if you always let it sleep on the hard floor. A dog bed can be very good because it provides a nice resting place for your dog. If your dog has its bed and knows this, it will rarely disturb you in your bed.

Dogs do not know how to respect a person’s space. If you do not have a nice, cosy and comfortable place set up for them, they will invade yours. Every night you will feel your dog on your comfortable bed if you always let it sleep on the hard floor. A dog bed can be very good because it provides a nice resting place for your dog. If your dog has its bed and knows this, it will rarely disturb you in your bed.

Enterprises rely on their partners and clients if they want to grow. To make your customers and partners feel welcome in your company office, ensure that you have accommodating furniture. Whether you are in another meeting or away from the office, they can wait for you to conclude your errands. Excellent office furniture is comfortable and relaxing.

Enterprises rely on their partners and clients if they want to grow. To make your customers and partners feel welcome in your company office, ensure that you have accommodating furniture. Whether you are in another meeting or away from the office, they can wait for you to conclude your errands. Excellent office furniture is comfortable and relaxing. Sometimes all you have to do to win clients and customers is to make your business as appealing as possible. The best way to make your enterprise attractive is by getting and fitting the appropriate tables and chairs. If your business premises creates an enticing vibe, the chances of getting more customers and building a good reputation are high.

Sometimes all you have to do to win clients and customers is to make your business as appealing as possible. The best way to make your enterprise attractive is by getting and fitting the appropriate tables and chairs. If your business premises creates an enticing vibe, the chances of getting more customers and building a good reputation are high.

Africa is a big continent, and there are hundreds of tribes and places to visit. Therefore, before setting off, you need to decide on the places and people you wish to meet. Note that every place and tribes has a unique history and lifestyle. Though some have adopted the modern lifestyle and dropped some of their old cultural practices, you will still learn a lot and get to see and hear fun stories about them.

Africa is a big continent, and there are hundreds of tribes and places to visit. Therefore, before setting off, you need to decide on the places and people you wish to meet. Note that every place and tribes has a unique history and lifestyle. Though some have adopted the modern lifestyle and dropped some of their old cultural practices, you will still learn a lot and get to see and hear fun stories about them. Once you have decided on the location you want to visit and you have packed well with respect to the weather, the next step is to find a reliable translator. You need to find someone who knows the language and can translate accurately. A good translator should be fluent in both your language and the language of the people of the area you are visiting.

Once you have decided on the location you want to visit and you have packed well with respect to the weather, the next step is to find a reliable translator. You need to find someone who knows the language and can translate accurately. A good translator should be fluent in both your language and the language of the people of the area you are visiting.

popular

popular

require so that you can choose the right one. You should also look at one’s online presence and social media following before deciding to hire them. Influencer marketing can be of great significance to your business in several ways some of which include:

require so that you can choose the right one. You should also look at one’s online presence and social media following before deciding to hire them. Influencer marketing can be of great significance to your business in several ways some of which include: service reaches your target audience effectively. You may want to reach out to people from a particular age bracket or gender. A good marketing agency will help you get an influencer who can reach out to the specific target audience you need.…

service reaches your target audience effectively. You may want to reach out to people from a particular age bracket or gender. A good marketing agency will help you get an influencer who can reach out to the specific target audience you need.…

e different types of rat traps, each with varied ease of use and degree of effectiveness. Some of the most common traps for getting rid of rats include snap traps electric or live traps. These traps are usually very effective in getting rid of rat infestations. Just buy the trap of your choice, set it up, place it in the nesting and feeding places of rats, and keep on checking to dispose of killed rats.

e different types of rat traps, each with varied ease of use and degree of effectiveness. Some of the most common traps for getting rid of rats include snap traps electric or live traps. These traps are usually very effective in getting rid of rat infestations. Just buy the trap of your choice, set it up, place it in the nesting and feeding places of rats, and keep on checking to dispose of killed rats.

Swim trunks are the most traditional type of swimwear worn by men of all ages. They are made of nylon, polyester or a blend. They are available in solid colors as well funky prints. Board shorts are preferred by younger people and children instead of traditional swim trunks because they are more comfortable and roomy. Swim trunks are loose and extend to someone’s mid-thigh.

Swim trunks are the most traditional type of swimwear worn by men of all ages. They are made of nylon, polyester or a blend. They are available in solid colors as well funky prints. Board shorts are preferred by younger people and children instead of traditional swim trunks because they are more comfortable and roomy. Swim trunks are loose and extend to someone’s mid-thigh. The Monokini Swimwear is one piece swimsuit. It has goat a strip that connects the top and bottom portions. They are worn by women and minority of the men since it is not comfortable for the average guy. Tankini swimwear: Tankini swimwear is also referred as a two piece swim suit. They are worn by women whereby the two pieces covers the breast and the stomach. They vary in different styles.…

The Monokini Swimwear is one piece swimsuit. It has goat a strip that connects the top and bottom portions. They are worn by women and minority of the men since it is not comfortable for the average guy. Tankini swimwear: Tankini swimwear is also referred as a two piece swim suit. They are worn by women whereby the two pieces covers the breast and the stomach. They vary in different styles.…

This applies mostly to newcomers in the market, who have no experience in the industry. Avoid rushing into anything without having carefully considered all the factors involved. If possible, diversify your options to reduce the chances of failing. It is also imperative to keep in tune with the current marketing trends. The principal objective should be to satisfy an ignored need or use efficient marketing strategies like telemarketing to reach out to specific customers.

This applies mostly to newcomers in the market, who have no experience in the industry. Avoid rushing into anything without having carefully considered all the factors involved. If possible, diversify your options to reduce the chances of failing. It is also imperative to keep in tune with the current marketing trends. The principal objective should be to satisfy an ignored need or use efficient marketing strategies like telemarketing to reach out to specific customers.

The offer of money can be too good. You might realize that you qualify for quite a lot of money and feel the temptation to borrow it all. However, before doing that, think about how you live and your monthly expenses. Will they allow a significant allocation to repayment of the cash advance loan that you are about to get? Be honest with yourself because you are about to sign an expense that will be part of your for quite some time. Taking a more extended repayment plan means that you will pay more interest. Another implication is that your monthly repayment might be lower. The repayment plan is a compromise between paying less for the money you borrow and paying fast the loan.

The offer of money can be too good. You might realize that you qualify for quite a lot of money and feel the temptation to borrow it all. However, before doing that, think about how you live and your monthly expenses. Will they allow a significant allocation to repayment of the cash advance loan that you are about to get? Be honest with yourself because you are about to sign an expense that will be part of your for quite some time. Taking a more extended repayment plan means that you will pay more interest. Another implication is that your monthly repayment might be lower. The repayment plan is a compromise between paying less for the money you borrow and paying fast the loan.

After you have moved to a new home, you will want to change the locks for safety measures. Because you got no idea who else has the spare keys to your home. Though you can decide to change the locks by yourself, it’s wise that you call a professional locksmith. The locksmith is the only person who will know the best lock to use.

After you have moved to a new home, you will want to change the locks for safety measures. Because you got no idea who else has the spare keys to your home. Though you can decide to change the locks by yourself, it’s wise that you call a professional locksmith. The locksmith is the only person who will know the best lock to use. When you are locked out of your house, it can be frustrating. But what the locksmith does nowadays is they will rush to the help, but before they open the home for security measure, they will always ask to see if you are the owner.…

When you are locked out of your house, it can be frustrating. But what the locksmith does nowadays is they will rush to the help, but before they open the home for security measure, they will always ask to see if you are the owner.…

Good scenery

Good scenery

Lighting your kitchen with a pendant provides flair to the cooking area. Besides their beautiful ambiance, they form a central point that gives the room an aesthetic appeal. Their large variety makes it easy to introduce a customized design into your kitchen.

Lighting your kitchen with a pendant provides flair to the cooking area. Besides their beautiful ambiance, they form a central point that gives the room an aesthetic appeal. Their large variety makes it easy to introduce a customized design into your kitchen. Fixing the fixture is equally an important procedure as choosing it. The distance from which it is hung determines the extent of lighting in the room. For task lighting, the bottom rim of the fixture should be 30-35 inches above the table. In an ambient lighting, the fixture’s lower edge needs to be 60-66 inches above the floor. If the ceiling is beyond 8 feet, add 3 inches for every additional foot to lower the pendant to the 60-66 inches height range.…

Fixing the fixture is equally an important procedure as choosing it. The distance from which it is hung determines the extent of lighting in the room. For task lighting, the bottom rim of the fixture should be 30-35 inches above the table. In an ambient lighting, the fixture’s lower edge needs to be 60-66 inches above the floor. If the ceiling is beyond 8 feet, add 3 inches for every additional foot to lower the pendant to the 60-66 inches height range.…

The Stag or the Deer stands for the birth group on 24 December and 20 January. The Cat represents the births between January 21 and February 17. The Adder or Snake takes on from February 18 to March 17. The Fox take on from March 18 to April 14. The Cow or the Bull represents births within April 15 and May 12; the Seahorse takes on from May 13 to June 9 while the Wren represents births from June 10 to July 7.

The Stag or the Deer stands for the birth group on 24 December and 20 January. The Cat represents the births between January 21 and February 17. The Adder or Snake takes on from February 18 to March 17. The Fox take on from March 18 to April 14. The Cow or the Bull represents births within April 15 and May 12; the Seahorse takes on from May 13 to June 9 while the Wren represents births from June 10 to July 7. These Celtic astrological symbols are very significant culturally because they tend to mirror that fact of how the beliefs and philosophies of the Celtics were heavily knotted into nature. It implies that nature and philosophy are not two separate things, but nature is entwined in everything from astrology and religion to daily interaction and life in the society.

These Celtic astrological symbols are very significant culturally because they tend to mirror that fact of how the beliefs and philosophies of the Celtics were heavily knotted into nature. It implies that nature and philosophy are not two separate things, but nature is entwined in everything from astrology and religion to daily interaction and life in the society.

When you are traveling to your special event, nothing can ruin your day like stressing about details like transportation, arriving late, getting lost on the way, traffic, parking just to mention a few. Hiring limo service Charlotte NC will let you relax as your transportation requirements are taken care of by professionals. Gone are the eras you had to stress about thinks like transportation to your special event. Apart from getting you to your event, limo service Charlotte NC will let you relax and remember about the fabulous time you had on your way back to your residence rather than driving yourself there since you will presumably be far too tired.

When you are traveling to your special event, nothing can ruin your day like stressing about details like transportation, arriving late, getting lost on the way, traffic, parking just to mention a few. Hiring limo service Charlotte NC will let you relax as your transportation requirements are taken care of by professionals. Gone are the eras you had to stress about thinks like transportation to your special event. Apart from getting you to your event, limo service Charlotte NC will let you relax and remember about the fabulous time you had on your way back to your residence rather than driving yourself there since you will presumably be far too tired. A professional limo service in Charlotte NC will also give you this benefit. If you don’t want to arrive late at your event or miss your flight hiring a limo service is the best solution.When you hire a limo service, you don’t have to worry about arriving late because the expert drivers will pick you up from your preferred location early enough to avoid any hassles. If you are going to the airfield, some limo service companies in Charlotte NC track your flight status to ensure that they are aware of any time adjustments that might make you arrive late so that they pick you up on time.…

A professional limo service in Charlotte NC will also give you this benefit. If you don’t want to arrive late at your event or miss your flight hiring a limo service is the best solution.When you hire a limo service, you don’t have to worry about arriving late because the expert drivers will pick you up from your preferred location early enough to avoid any hassles. If you are going to the airfield, some limo service companies in Charlotte NC track your flight status to ensure that they are aware of any time adjustments that might make you arrive late so that they pick you up on time.…

The recent and the most trending technology is the Facebook selfie frame. As we know, photos are used to remind us of memories and also to express feelings. Selfie frames have come to complete the look of the picture. There are hundreds of picture frames in Facebook that one can use when taking selfie pictures to tell a story. The selfie frames are of different types, so it’s up to one to choose the best frame to use. Facebook selfie frames can be used in various areas as discussed below.

The recent and the most trending technology is the Facebook selfie frame. As we know, photos are used to remind us of memories and also to express feelings. Selfie frames have come to complete the look of the picture. There are hundreds of picture frames in Facebook that one can use when taking selfie pictures to tell a story. The selfie frames are of different types, so it’s up to one to choose the best frame to use. Facebook selfie frames can be used in various areas as discussed below. A Facebook selfie frame includes a username that may be real or not real, a location of where the event or party is located, details of how long ago the picture was taken, number of likes just like in the social media application, these number is normally dependent on you and the words that you wish to add after the user name.…

A Facebook selfie frame includes a username that may be real or not real, a location of where the event or party is located, details of how long ago the picture was taken, number of likes just like in the social media application, these number is normally dependent on you and the words that you wish to add after the user name.…

Steam driven machines were the first to be manufactured and are still used today. They use steam pressure to make espresso. However, they are less preferred since they don’t create enough pressure to produce high-quality espresso. Because of this, they have lower prices compared to the pump driven machines.

Steam driven machines were the first to be manufactured and are still used today. They use steam pressure to make espresso. However, they are less preferred since they don’t create enough pressure to produce high-quality espresso. Because of this, they have lower prices compared to the pump driven machines.

A home espresso machine is something you must have. It will save you a lot of time in those mornings you accidentally oversleep. Prices may vary depending on size, manufacturer, the technology used, and other factors. All you should know is that there’s an espresso machine out there that fits your budget. So next time you’re out, grab yourself one and watch your mornings brighter!

A home espresso machine is something you must have. It will save you a lot of time in those mornings you accidentally oversleep. Prices may vary depending on size, manufacturer, the technology used, and other factors. All you should know is that there’s an espresso machine out there that fits your budget. So next time you’re out, grab yourself one and watch your mornings brighter!

Massage the gum

Massage the gum

work environment

work environment

made of plastic in our homes, but not all of them are 3D printed. Some materials are made from a mixture of materials, and that cannot be done from just anywhere.

made of plastic in our homes, but not all of them are 3D printed. Some materials are made from a mixture of materials, and that cannot be done from just anywhere. 3D printing is done in layers that mean the products are not strong enough. The layers don’t bond enough. They only provide strength when pressing down but has a laminate weakness. Since they are not guaranteed strength, they can break easily.

3D printing is done in layers that mean the products are not strong enough. The layers don’t bond enough. They only provide strength when pressing down but has a laminate weakness. Since they are not guaranteed strength, they can break easily.

Featherbeds are incredibly soft and gentle materials. As such, if are looking for something that is lightweight and soft, these units can never disappoint. Moreover, featherbeds have excellent heat regulation properties. Meaning that you summer nights will always be cool and your winter ones warm. Thus, if you are shopping for one, a unit with a thread count of at least 200 should serve the purpose and last considerably long.

Featherbeds are incredibly soft and gentle materials. As such, if are looking for something that is lightweight and soft, these units can never disappoint. Moreover, featherbeds have excellent heat regulation properties. Meaning that you summer nights will always be cool and your winter ones warm. Thus, if you are shopping for one, a unit with a thread count of at least 200 should serve the purpose and last considerably long.

You deserve to reward yourself for your accomplishments.You should celebrate for getting something done and get excited and take pride in yourself.

You deserve to reward yourself for your accomplishments.You should celebrate for getting something done and get excited and take pride in yourself.